what percentage of taxes are taken out of paycheck in nc

Both employee and employer shares in paying these taxes. What percentage of taxes are taken out of payroll.

How To Track A North Carolina Tax Refund Credit Karma

The income tax is a flat rate of 499.

. For Tax Years 2017 and 2018 the North Carolina individual income tax rate is. 95-258 Withholding of Wages an employer may withhold or divert any portion of an employees wages when. Current FICA tax rates.

Use ADPs North Carolina Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Hourly non-exempt employees must be paid time and a. North Carolina Income Taxes.

95-258 a 1 - The employer is required to. This money goes to the IRS where it is counted toward your annual income taxes. Total income taxes paid.

No state-level payroll tax. Current FICA tax rates. Effective January 1 2020 a payer must deduct and withhold North Carolina income tax from the non-wage compensation paid to a payee.

The median household income is 52752 2017. That rate applies to. The employer portion is 15 percent and the.

North Carolinas flat tax rate for 2018 is 549 percent and standard deductions were 8750 if you filed as single and 17500 if you were. Social Security Tax. Instead the income limit for the lifetime learning credit has been increased.

What percentage does NC take out for taxes. Besides FICA taxes you will see federal income taxes are also taken out of your paychecks. A total of 153 124 for social security and 29 for Medicare is applied to an employees gross compensation.

The current tax rate for social security is 62 for the employer and 62 for the employee or. What is the percentage that is taken out of a paycheck. For Tax Years 2017.

Subtract and match 62 of each employees taxable wages until they have earned 147000 2022 tax year for that calendar year. North Carolina Paycheck Calculator. The current tax rate for social security is 62 for the employer and 62 for the employee or 124.

The federal government requires that you pay 62 percent of your gross pay for FICA taxes and one-half of your Medicare taxes. Ad Learn More About the Adjustments to Income Tax Brackets in 2022 vs. North Carolina moved to a flat income tax beginning with tax year 2014.

The money also grows tax-free so that you only pay income tax when you withdraw it at which point it has hopefully grown substantially. Take Your 2019 Standard Deduction. To use the calculator.

How much tax is deducted from my. 124 to cover Social Security and 29 to cover Medicare. Some deductions from your paycheck are made.

Minimum Wage in North Carolina in 2021. Social Security has a wage base limit which for 2022 is. For tax year 2021 all taxpayers pay a flat rate of 525.

525 For Tax Years 2019 2020 and 2021 the North Carolina individual income tax rate is 525 00525. For more information see Form 8863 and its instructions. For Tax Years 2019 and 2020 the North Carolina individual income tax rate is 525 00525.

Amount taken out of an average biweekly paycheck. Just enter the wages tax. The amount of taxes to be.

Raleigh NC 27609 Map It. Total income taxes paid. The Calculator will help you identify your tax withholding to make sure you have the right amount of tax withheld from your paycheck.

Discover Helpful Information and Resources on Taxes From AARP. This 153 federal tax is made up of two parts.

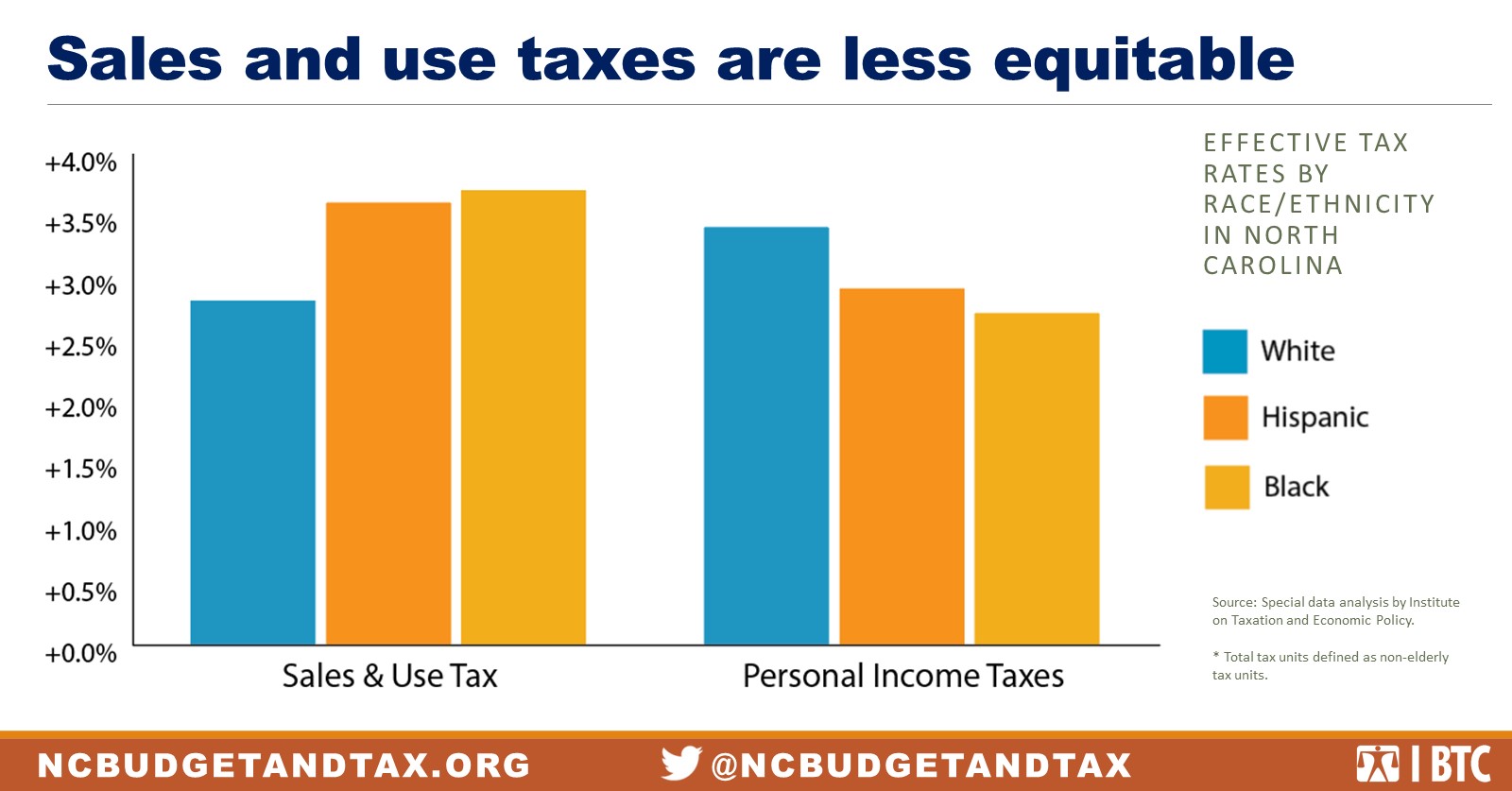

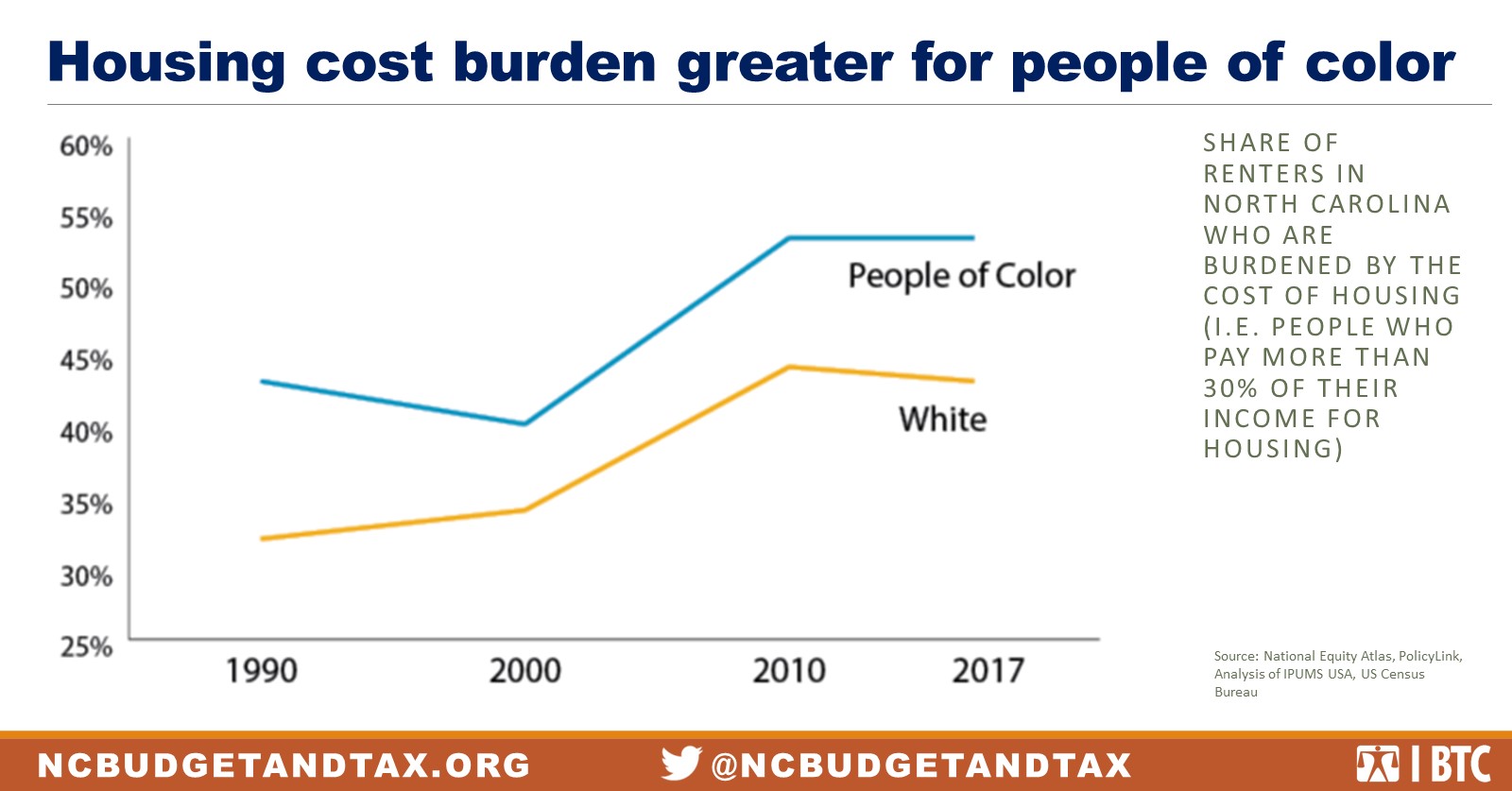

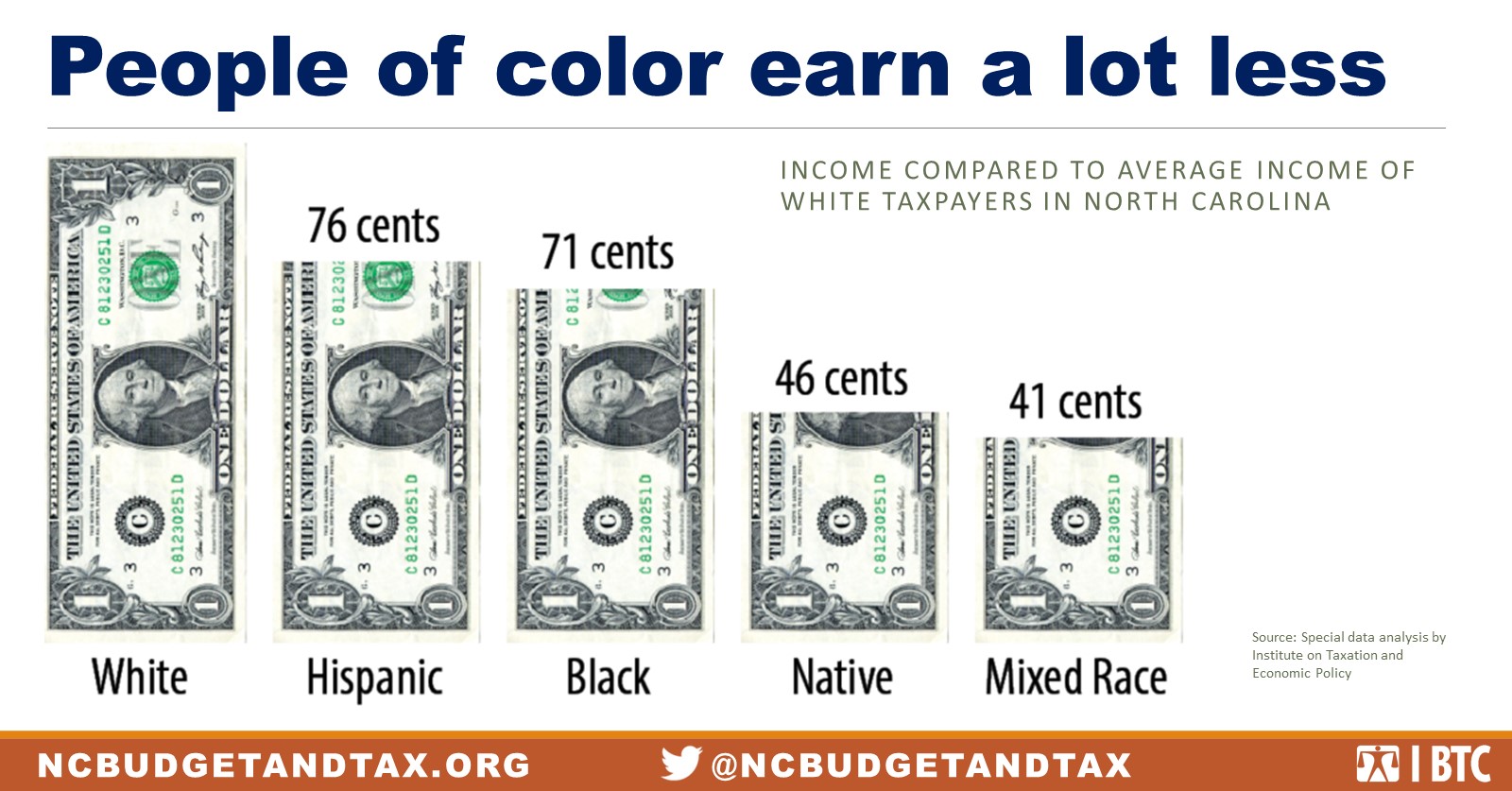

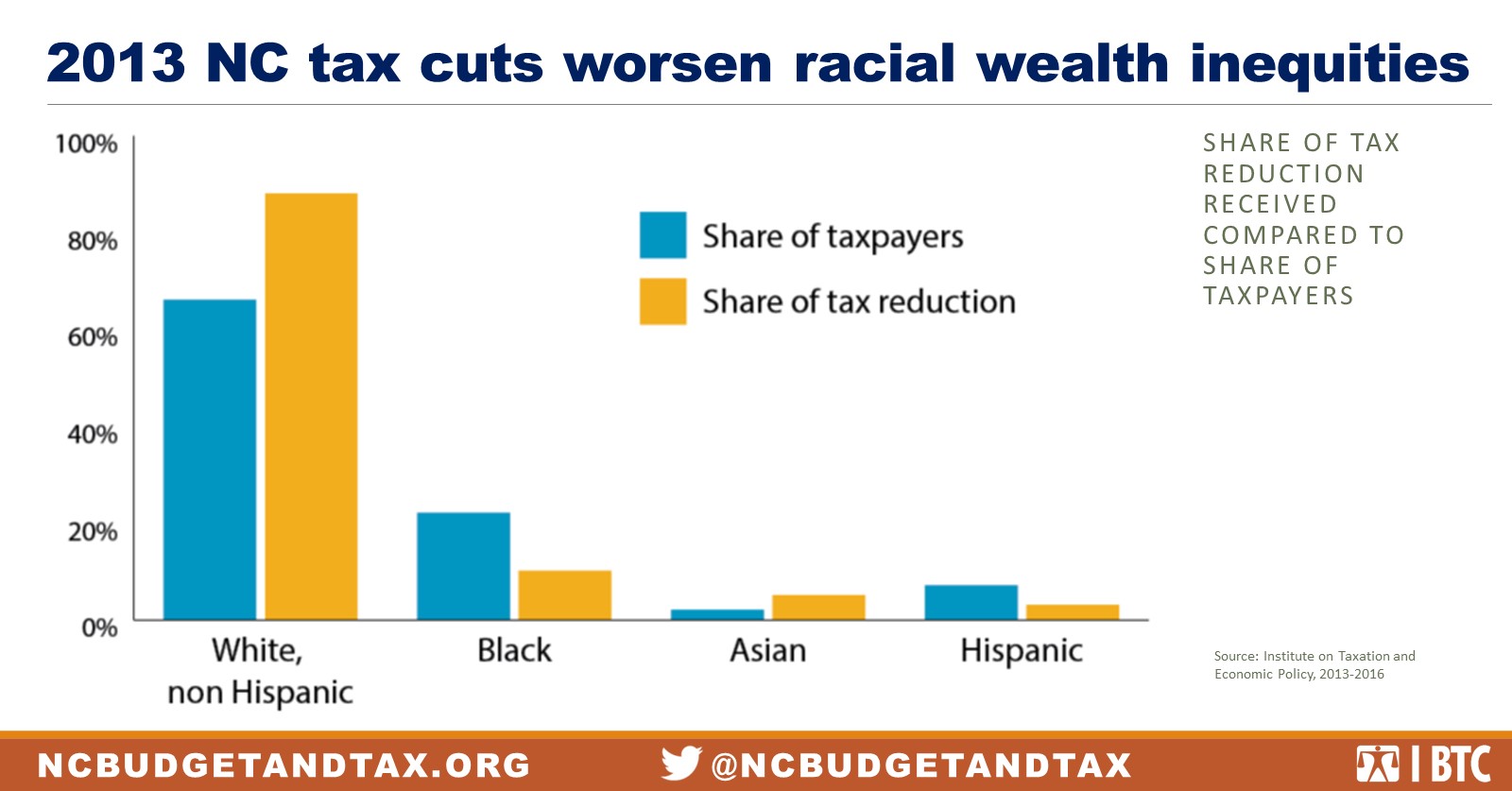

State Tax Policy Is Not Race Neutral North Carolina Justice Center

New Nc Laws For 2022 Include Lower Taxes And A Focus On Police Officers Mental Health Wfae 90 7 Charlotte S Npr News Source

Proctologist Salary In Charlotte Nc Comparably

How The Tax Cuts And Jobs Act Is Helping North Carolina Americans For Tax Reform

Dialysis Nurse Salary In Charlotte Nc Comparably

North Carolina Paycheck Calculator Smartasset

State Tax Policy Is Not Race Neutral North Carolina Justice Center

State Tax Policy Is Not Race Neutral North Carolina Justice Center

North Carolina Paycheck Calculator Smartasset

North Carolina Income Tax Calculator Smartasset

State Tax Policy Is Not Race Neutral North Carolina Justice Center

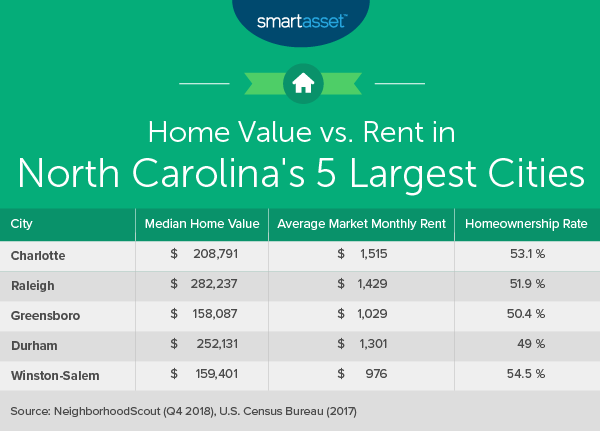

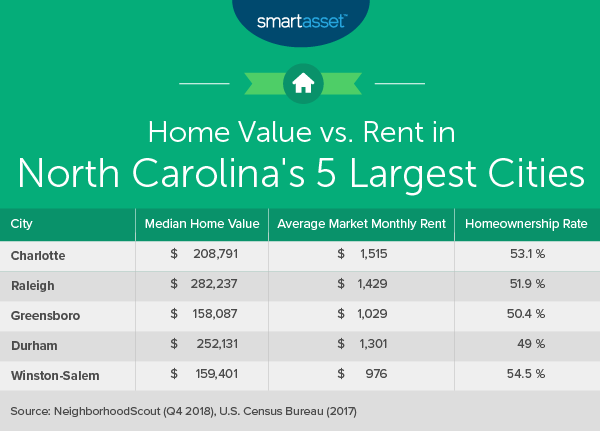

The Cost Of Living In North Carolina Smartasset

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

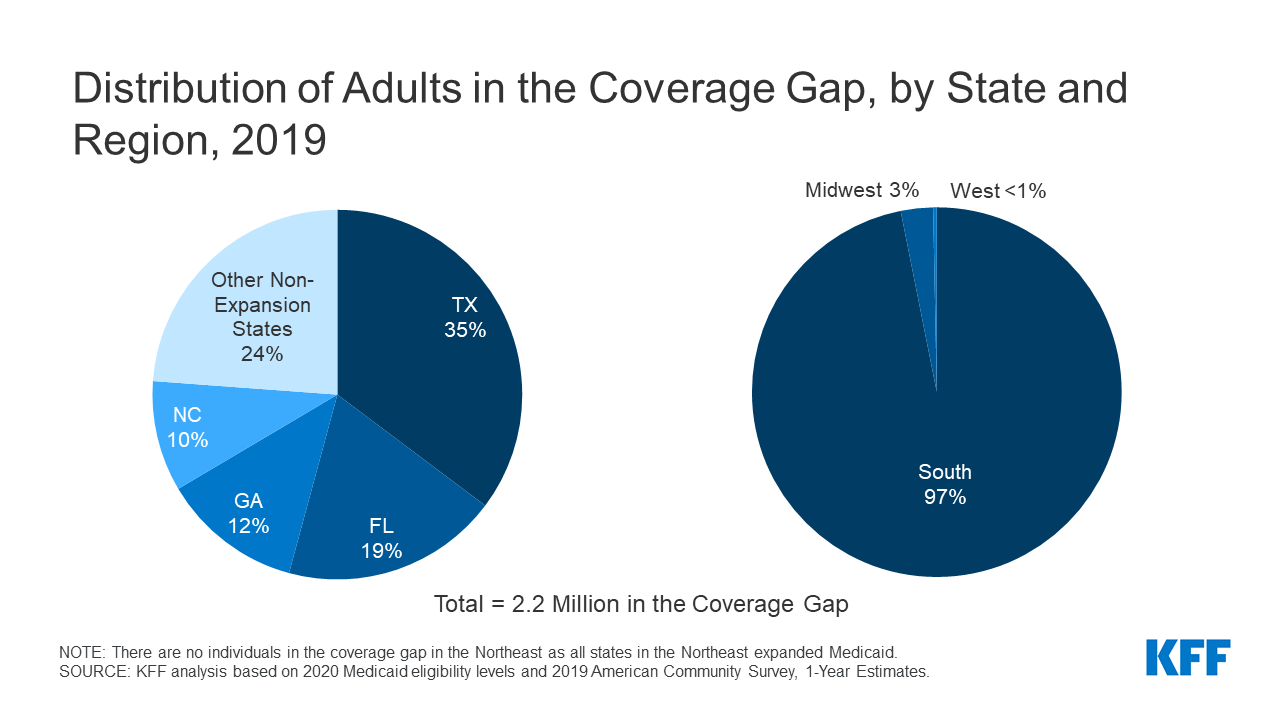

The Coverage Gap Uninsured Poor Adults In States That Do Not Expand Medicaid Kff

State Tax Policy Is Not Race Neutral North Carolina Justice Center